The Cybersecurity Revolution No One Saw Coming

Google recently invested $32 billion in Wiz, a Cloud Security Platform. This acquisition underscores the immense value of securing the cloud layer of the tech stack. Each layer of infrastructure—networks, clouds and data (Snowflake, Databricks)—creates massive opportunities for innovation and security. As Google strengthens its cloud security position, the next frontier is security for the modern AI data stack, and it remains to be seen who will own that market.

A deal of this scale highlights the urgency around cloud security. And yet, the biggest security failures rarely stem from cutting-edge attacks. They happen because of mundane, preventable errors: misconfigurations, unpatched vulnerabilities, gaps buried in terabytes of noise. That’s where AI changes the game. Not because it’s smarter than humans but because it never gets tired of watching, analyzing and catching what we miss.

With the cybersecurity AI market projected to hit $60.6 billion by 2028 (growing at 21.9% CAGR), security is shifting from reactive guesswork to a structured, data-driven discipline. AI is turning cybersecurity from an unpredictable arms race into a system that can be continuously understood, improved and secured.

The Fundamental Shift: How AI Is Changing Security

Cybersecurity has always involved an ongoing challenge. Build defenses; attackers circumvent them. Fix vulnerabilities, and new ones emerge. We’ve operated on detection and response for decades, with humans as the ultimate decision makers.

AI is changing this equation in three significant ways.

1. Security economics is inverting. Traditional signature-based systems kept defenders perpetually behind. Now, behavioral AI model can identify anomalies without needing to see the attack beforehand. This shifts the advantage from attackers to defenders.

2. Threat volume has outpaced human capacity. Some of the biggest enterprises face over 1,000 security alerts daily. AI-powered analysis summarizes critical alerts and automates responses, accelerating investigations by approximately 55%.

3. The attack surface continues expanding. IoT devices, cloud infrastructure and remote work have dissolved traditional security boundaries. AI-driven approaches provide the only practical method to protect environments that change hourly.

Where AI Creates Investment Opportunities

The intersection of AI and security creates several distinct market opportunities:

• Autonomous Security Operations: The tiered approach to security is being reinvented through AI. What once required teams of Tier 1 agents performing 24/7 monitoring, Tier 2 agents handling containment and Tier 3 specialists conducting forensics can now be orchestrated through autonomous systems.

• Predictive Security Intelligence: Traditional approaches to vulnerabilities and threats are increasingly outdated. Forward-thinking companies use AI to predict which vulnerabilities attackers will target and automate routine security tasks like phishing detection.

• Identity-Centered Protection: With perimeter dissolution, identity has become security’s cornerstone. AI systems that continuously authenticate users based on behavioral patterns show the strongest sector revenue growth.

• Supply Chain Integrity: Advanced attacks increasingly target software supply chains. AI systems verifying code provenance and detecting tampering throughout development address the core principles of integrity and non-repudiation.

When AI Becomes A Security Challenge

Although the benefits are vast, AI is still being used to power cyber attacks that rapidly evolve in both sophistication and frequency, leveraging advanced algorithms to automate, personalize and scale malicious activities. The most common forms of these attacks to be aware of include:

• Phishing And Social Engineering: Generative AI crafts hyper-personalized phishing emails and real-time scam chatbots.

• Deepfakes And Voice Cloning: Realistic impersonations enable fraud and bypass authentication.

• Adaptive Malware And Adversarial Attacks: AI automates malware evolution, system manipulation and large-scale scams.

These attack types are not only more difficult to detect and prevent, but they also operate at a scale and speed that traditional cybersecurity measures struggle to match. With this in mind, humans will remain irreplaceable in cybersecurity for:

• Strategic Security Planning: Humans remain essential for designing security architectures, setting policies and ensuring legal/ethical compliance, areas where AI lacks contextual understanding.

• Adaptive Threat Response: Human expertise is critical for investigating zero-day attacks, creative problem-solving and post-incident analysis to improve defenses.

• Human-AI Partnership: Resilient cybersecurity relies on combining AI’s capabilities with human skills in crisis communication, stakeholder management and strategic decision making.

Evolving Security Through AI-First Principles

The security landscape continues evolving in ways that favor AI-native approaches:

• Zero-Trust AI Architectures: The move to AI-first architectures means companies have more complex, interconnected systems running across multiple cloud providers, helping secure entire cloud infrastructures, identifying risks before they become breaches.

• AI-Powered Attack Systems: Security teams increasingly defend against automated attack platforms. Approximately 74% of security professionals report their organizations experiencing substantial impacts from AI-driven threats, creating an escalating AI vs. AI security environment.

• Privacy-Centered Design: As regulations evolve and consumer awareness grows, security systems built with privacy as a core design principle create market differentiation beyond compliance. The companies that will dominate aren’t just securing data—they’re respecting it.

What’s Next: Consolidation And Opportunity

Industry consolidation continues accelerating. For founders and investors, opportunities extend beyond addressing the talent gap (expected to reach 3.5 million unfilled positions by 2025). The most promising companies will reimagine security operations for environments where human expertise and AI complement each other.

The most compelling investment opportunities won’t be simply applying AI to existing security workflows but developing entirely new approaches to persistent security challenges, like Wiz, which developed full-stack visibility across multicloud environments. That’s where I’ll be looking for the next unicorn, and that’s where we can expect the outsized returns to be found.

Originally published in the Forbes

What’s New in AI SaaS Funding?

SaaS is dead. Or at least, that’s the narrative floating around from VCs, industry leaders, and even Satya Nadella himself. And when the CEO of a $3 trillion company says something, there must be some merit to the statement

As someone who has sat on both sides of the tables, I see a more nuanced reality unfolding and it doesn’t take a genius to guess that AI has been mongering over our heads to transform SaaS as we knew it, yesterday a year or a decade back. And AI’s influence is extending far beyond traditional software budgets—it’s now making inroads into labor spend, fundamentally reshaping how businesses allocate resources. Current Market Dynamics

Venture funding to U.S. companies totaled $178 billion — gobbling up 57% of global capital. The Bay Area absorbed $90 billion of this – a 50% jump from 2023, thanks to the boom from AI investing.

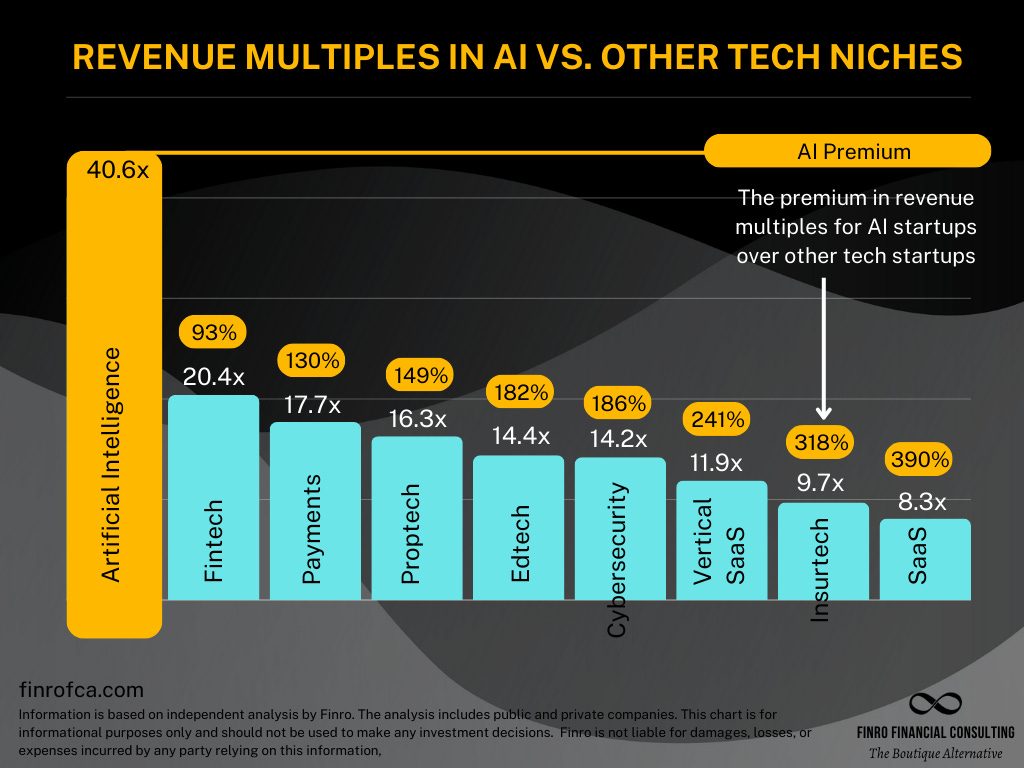

As per crunchbase, funding to AI-related companies crossed $100 billion. That’s an 80% YoY surge from $55.6 billion in 2023. Investor confidence is evident in the numbers as AI SaaS startups are commanding revenue multiples of 37.5x, significantly higher than the average SaaS multiple of 7.6x (finrofca). The speed at which AI is scaling makes every other wave of innovation look slow.

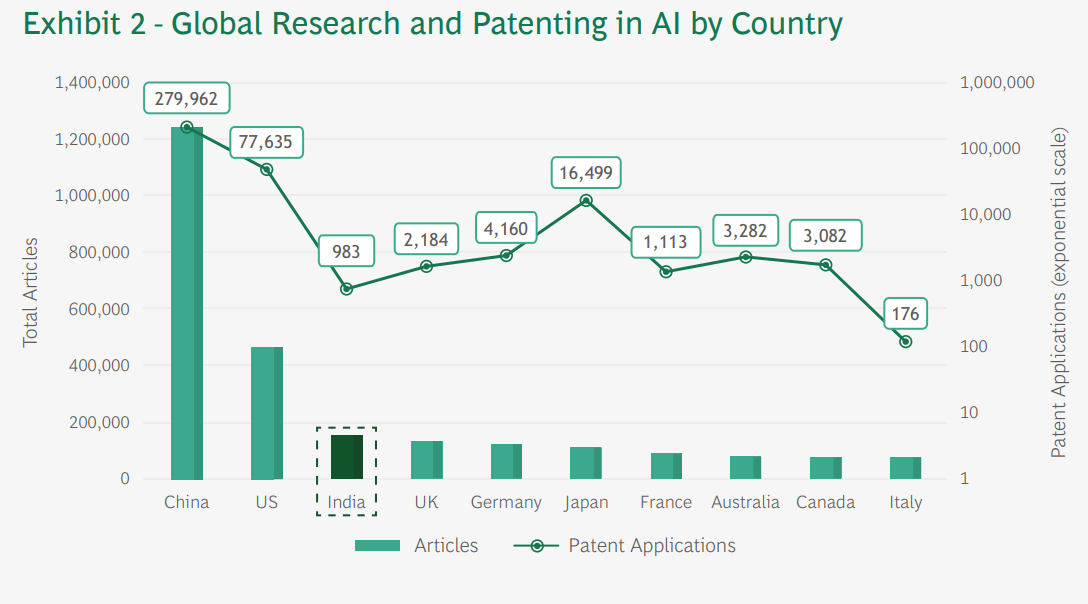

Much of this momentum comes down to R&D investment. It’s no coincidence that China, the U.S., and Japan—home to the highest concentration of AI patent applications – are also leading the charge in developing the most advanced foundational models.

Where’s the Money Moving?

-

Seed Stage – AI companies are raising rounds 28% higher than non AI startups

Nearly 3 in 4 AI deals (74%) were early-stage in 2024. AI startups raising seed rounds are seeing median rounds of $1.6 million – that’s 28% higher than non-AI startups, who’re pulling in about $1.25 million.

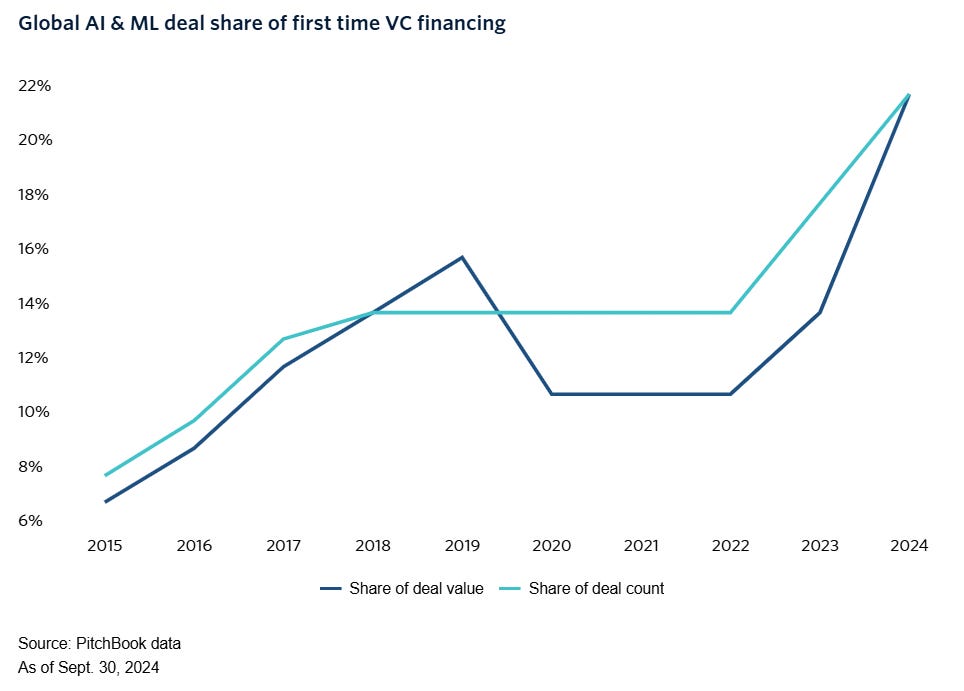

AI startups made up 22% or $7 billion of first-time VC financing. Just two years ago, that number was half.

Source: Pitchbook

The barrier to entry for AI has lowered, thanks to accessible cloud resources, open-source models and fine-tuning APIs. The real differentiator at this point is deep technical defensibility and teams’ ability to solve hard enterprise problems, not just layering AI on existing workflows.

-

Series A & B median valuations are 2.5x higher

The median AI pre-money valuations of Series A and Series B are $34.0M and $150.0M valuation, respectively. AI startups in these rounds are seeing median valuations 2.5x higher than in traditional SaaS.

Why? Because If you’ve made it to Series A/B, investors are now betting on you to achieve hyperscale adoption. But not all will make it. The adoption cycles in enterprise AI are brutal, and many of these companies are realizing that just because the tech is promising doesn’t mean it fits into existing workflows. Some will break through. Many won’t.

-

Growth Stage (Series C & Beyond) demands proprietary infrastructure

This is where the pressure is mounting. The biggest AI bets of 2024 include Databricks ($10B round), OpenAI ($6.6B), xAI ($6B), and Anthropic ($4B). These late-stage rounds are dominated by hyperscalers and sovereign wealth funds, signaling that true differentiation now demands proprietary infrastructure, not just incremental improvements.

The capital is there, but so are sky-high expectations. The ones solving real problems will raise massive rounds. The rest? They’ll burn out just as fast as they took off.

Source: finrofca

How different industries are adopting

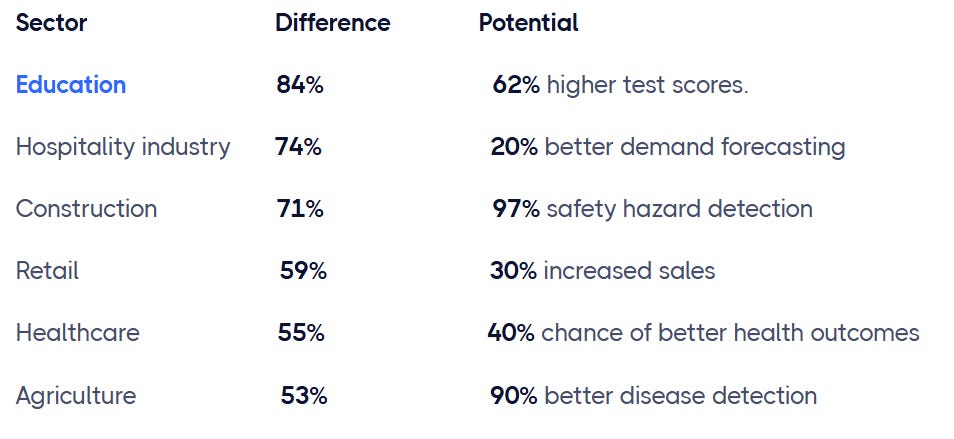

AI funding across industries is directly proportional to the substantial data volumes, potential for automation and the complexity of existing operational workflows. An Accenture report shows the profit potential in these industries after implementing AI integrations.

Source: Springsapps

-

Healthcare & Life Sciences: AI is revolutionizing drug discovery, diagnostics, and clinical workflows. Currently, 79% of healthcare organizations have adopted AI technology; $3.20 is made for every $1 invested. AI is moving from experimental technology to core infrastructure in medical delivery.

-

Finance: From fraud detection to automated underwriting and trading algorithms, generative AI alone could contribute $200–340 billion annually to global banking, primarily through productivity gains.

-

Manufacturing & Supply Chain: AI-driven predictive maintenance, logistics optimization, and robotics are redefining efficiency, reducing downtime, and streamlining operations.

Market Correction in Full Swing

Low-hanging fruits like customer service, automation, and sales are now dime a dozen. AI in developer tools has been commoditized. And when tech gets cheaper, returns shrink, investors pull back, and the price tags start correcting themselves. Incumbents will take the advantage, evident in 384 AI acquisitions in 2024, nearly matching 2023’s 397.

The AI gold rush isn’t over, but the market’s getting a reality check. Unsustainable burn, superficial value propositions, and the incumbent disadvantage are driving this consolidation.

It’s Back to the Fundamentals

At the end of the day, funding metrics and exit multiples make for good headlines, but they’re not the whole story. The enduring companies will be built by teams who understand that AI isn’t just a technical challenge – it’s a transformation challenge. Whether you’re writing checks or cashing them, it’s time to wear the operator’s hat and get back to the basics. Which ones, will make it? Here’s a framework that will help evaluate that: AI Startups: does your idea have hype, hope, or is it a hard pass

If Software Ate the World, AI’s Digesting It

They say lightning never strikes twice, but technology has proven this wrong time and again. The 90s saw enterprises transform through ERPs. The late 1990s ushered in the SaaS revolution, with Salesforce’s founding in 1999 fundamentally changing how businesses consume software. Cloud computing took off in the late 2000s with AWS’s launch in 2006, letting […]

Founders Creative: The Mission

A few years ago I found myself on the road 12 weeks of the year as a startup founder from Las Vegas to Amsterdam. I challenged myself to put myself on every stage in the cities I traveled in and encountered some very sharp white and male elbows. It was amusing just as much as […]